Psychometrics, the Science Behind Modern Risk Profiling

How do you view risk? What makes you unique in the way you make financial decisions? These are extremely important questions in helping a financial advisor better understand you and how they should advise you, especially when it comes to your financial plan and your investments. Many risk questionnaires today are one-dimensional and don’t seek to understand your financial personality and risk profile.

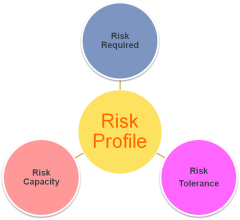

Psychometrics is the blending of psychology and statistics. It is the scientific discipline for testing personal characteristics such as risk tolerance. Risk profiling is a process aimed at finding the optimal level of investment risk for you considering the risk required, risk capacity, and risk tolerance, where,

- risk required is the risk associated with the return required to achieve the client’s goals from the financial resources available,

- risk capacity is the level of financial risk the client can afford to take, and

- risk tolerance is the level of risk the client is comfortable with.1

While your risk tolerance is important, we’ll look at it relative to your risk capacity and the risk required. This usually prompts a fruitful discussion with our clients to help to uncover any inconsistencies between each of these components of their risk profile.

If you’re interested in learning your Financial Personality and Risk Profile simply click the button to be taken to the questionnaire. It will take approximately 5 minutes to complete.

1 See www.finametrica.com or www.riskprofiling.com for more details, or download the following white papers for more information.